Introduction to Cryptocurrency Future Abbreviations

The world of cryptocurrency is rapidly evolving, and with it comes the need for efficient and concise ways to refer to these digital assets. As the number of cryptocurrencies continues to grow, so does the importance of standardized abbreviations. This article explores the potential future abbreviations for cryptocurrencies and their significance in the digital finance landscape.

Current Cryptocurrency Abbreviations

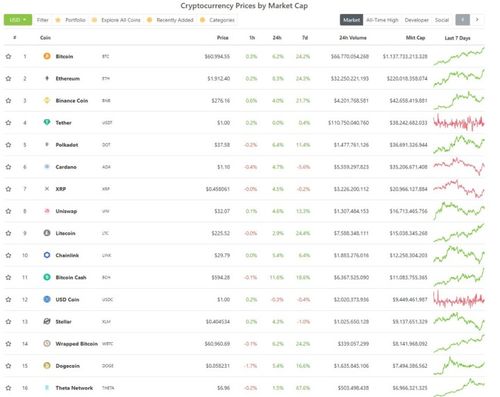

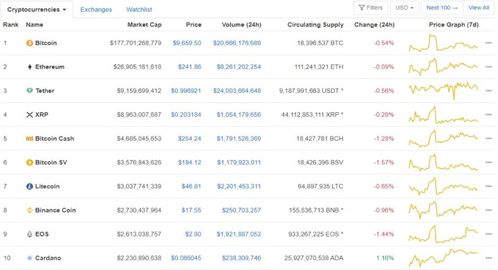

Before diving into the future abbreviations, it's essential to understand the current landscape. Many cryptocurrencies are already assigned abbreviations, often derived from their names or symbols. For instance, Bitcoin is commonly abbreviated as BTC, Ethereum as ETH, and Litecoin as LTC. These abbreviations are widely recognized and used in various contexts, including exchanges, forums, and official documentation.

Standardization Efforts

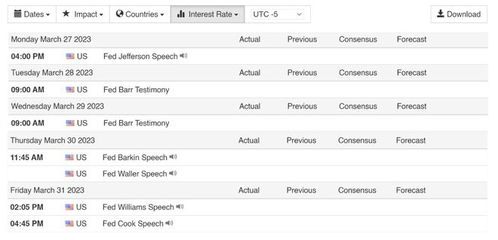

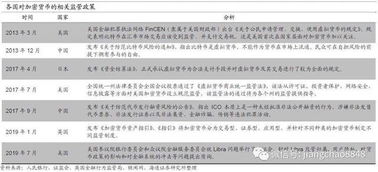

As the cryptocurrency market expands, there is a growing need for standardized abbreviations. This is particularly important for regulatory bodies, financial institutions, and global markets. Efforts to establish standardized abbreviations are being made through organizations such as the International Organization for Standardization (ISO) and the Financial Action Task Force (FATF). These efforts aim to ensure consistency and clarity in communication across different regions and industries.

Potential Future Abbreviations

Looking ahead, several potential abbreviations for cryptocurrencies could emerge. Here are a few examples:

BTC - Bitcoin: This abbreviation is already widely recognized and is likely to remain the standard for Bitcoin.

ETH - Ethereum: Similar to Bitcoin, ETH is a well-established abbreviation for Ethereum.

LTC - Litecoin: The abbreviation LTC is already in use and is expected to continue being the standard for Litecoin.

BNB - Binance Coin: As one of the most popular altcoins, BNB could potentially become the standard abbreviation for Binance Coin.

ADA - Cardano: ADA is a potential abbreviation for Cardano, which is gaining traction in the market.

DOT - Polkadot: DOT could become the abbreviation for Polkadot, a blockchain platform designed for interoperability.

LINK - Chainlink: The abbreviation LINK could be adopted for Chainlink, a decentralized oracle network.

Challenges and Considerations

While potential future abbreviations for cryptocurrencies are exciting, there are several challenges and considerations to keep in mind:

Market Volatility: Cryptocurrencies are known for their volatility, which can make it difficult to establish stable abbreviations.

New Entrants: The cryptocurrency market is constantly evolving, with new projects entering the space regularly. This can lead to a need for new abbreviations.

Language and Cultural Differences: Abbreviations may vary by region and language, which can complicate global communication.

Regulatory Compliance: Standardized abbreviations must comply with regulatory requirements and be recognized by financial authorities.

The Importance of Abbreviations in Cryptocurrency

Despite the challenges, standardized abbreviations are crucial for the growth and development of the cryptocurrency market. They facilitate communication, improve efficiency, and help to establish a common language among participants. As the industry continues to mature, the importance of these abbreviations will only increase.

Conclusion

The future of cryptocurrency abbreviations is an evolving topic. As the market grows and new projects emerge, the need for standardized, concise, and universally recognized abbreviations will become even more critical. By addressing the challenges and considering the various factors at play, the cryptocurrency community can work towards a future where abbreviations play a vital role in the digital finance landscape.

cryptocurrencyfuture cryptocurrencyabbreviations standardization digitalfinance cryptocurrencymarket