Introduction to Cryptocurrency Data Analysis

The world of cryptocurrency has grown exponentially over the past decade, attracting both investors and enthusiasts. With the rise of digital currencies like Bitcoin, Ethereum, and Litecoin, the need for data analysis in this sector has become increasingly important. This article delves into the realm of cryptocurrency data analysis, exploring its significance, methods, and potential challenges.

Significance of Cryptocurrency Data Analysis

Cryptocurrency data analysis plays a crucial role in understanding market trends, making informed investment decisions, and ensuring the security of digital assets. Here are some key reasons why data analysis is vital in the cryptocurrency space:

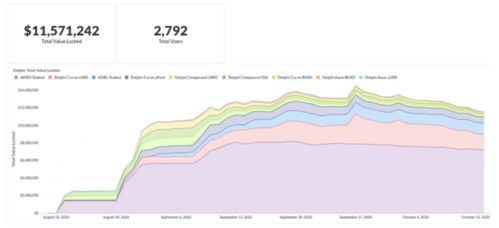

Market Trends: Analyzing historical data helps identify patterns and trends that can predict future market movements.

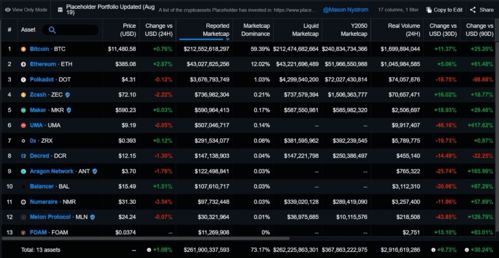

Investment Decisions: Data analysis provides insights into the performance of different cryptocurrencies, aiding investors in making well-informed decisions.

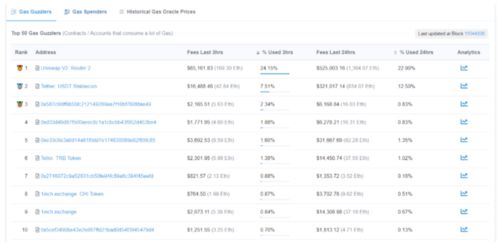

Security: Monitoring transaction data helps detect anomalies and potential security breaches, ensuring the safety of digital assets.

Methods Used in Cryptocurrency Data Analysis

Several methods are employed in cryptocurrency data analysis, including:

Technical Analysis: This involves studying historical price data and using various indicators to predict future price movements.

Sentiment Analysis: Examining social media, forums, and news articles to gauge the overall sentiment towards a particular cryptocurrency.

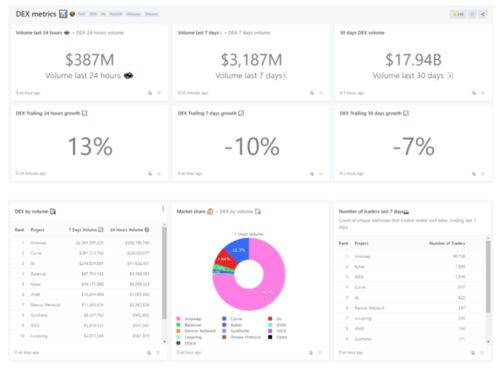

Network Analysis: Analyzing the relationships between different participants in the cryptocurrency ecosystem to identify influential nodes and potential risks.

Challenges in Cryptocurrency Data Analysis

Despite its importance, cryptocurrency data analysis faces several challenges:

Volatility: Cryptocurrency markets are highly volatile, making it difficult to establish reliable patterns and trends.

Regulatory Uncertainty: The lack of a unified regulatory framework for cryptocurrencies can lead to inconsistencies in data collection and analysis.

Data Quality: The availability and reliability of data can vary significantly, impacting the accuracy of analysis.

Scalability: As the number of cryptocurrencies and transactions increases, the scalability of data analysis tools becomes a concern.

Tools and Technologies for Cryptocurrency Data Analysis

Several tools and technologies are available to facilitate cryptocurrency data analysis:

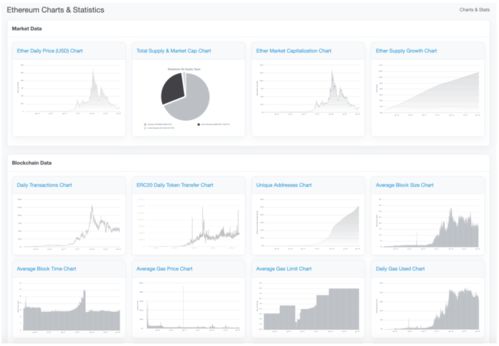

Trading Platforms: Many cryptocurrency exchanges provide APIs that allow users to access historical and real-time data.

Blockchain Explorers: These platforms offer detailed information about transactions, addresses, and blocks on a particular blockchain.

Data Analytics Software: Tools like Python, R, and Excel are commonly used for analyzing cryptocurrency data.

Machine Learning Algorithms: Advanced algorithms can be employed to predict market trends and identify anomalies.

Case Study: Bitcoin Price Analysis

To illustrate the application of data analysis in cryptocurrency, let's consider a case study on Bitcoin price analysis:

Data Collection: Gather historical price data from various sources, such as CoinMarketCap and Blockchain Explorers.

Technical Analysis: Apply technical indicators like moving averages, RSI, and MACD to identify potential buy and sell signals.

Result Interpretation: Analyze the results to make informed decisions about potential investment opportunities or market trends.

Conclusion

Cryptocurrency data analysis is a critical component of the digital currency ecosystem. By leveraging various methods and tools, analysts can gain valuable insights into market trends, investment opportunities, and security concerns. However, it is essential to be aware of the challenges and limitations associated with cryptocurrency data analysis to ensure accurate and reliable results.

Tags

CryptocurrencyDataAnalysis Bitcoin TechnicalAnalysis QuantitativeAnalysis Blockchain DigitalCurrency Investment MarketTrends Security