Introduction to Cryptocurrency Analysis

The world of cryptocurrency has been a topic of great interest and debate in recent years. As digital currencies gain more traction, it's essential to understand the various aspects that contribute to their analysis. This article aims to provide a comprehensive overview of the key factors that influence the analysis of cryptocurrencies, presented in a tabular format for easy reference.

Table of Contents

1. Definition and Characteristics of Cryptocurrency

2. Market Capitalization

3. Trading Volume

4. Price Volatility

5. Market Sentiment

6. Blockchain Technology

7. Regulatory Environment

8. Conclusion

1. Definition and Characteristics of Cryptocurrency

Cryptocurrency is a digital or virtual asset designed to work as a medium of exchange. It uses cryptography to secure transactions, control the creation of additional units, and verify the transfer of assets. Key characteristics include decentralization, limited supply, and the ability to be transferred without a central authority.

2. Market Capitalization

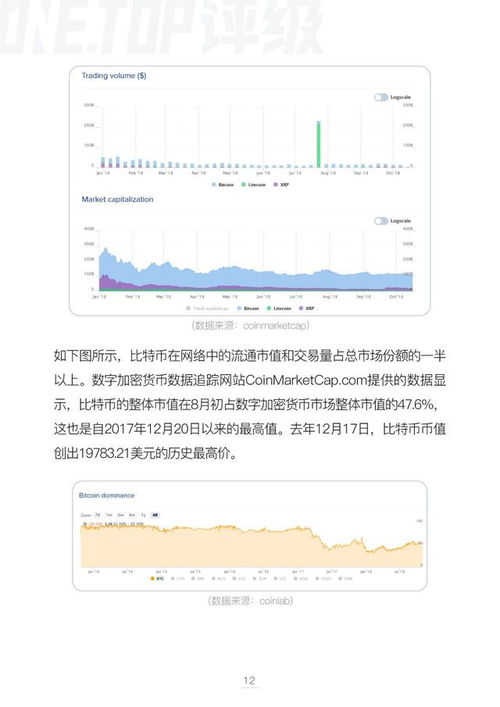

Market capitalization is the total value of all coins or tokens in circulation. It is calculated by multiplying the current price of the cryptocurrency by the total number of coins in circulation. This metric is crucial for understanding the size and potential of a cryptocurrency in the market.

Cryptocurrency

Market Capitalization

Current Price

Total Coins in Circulation

Bitcoin (BTC)

$1,000,000,000,000

$50,000

18,800,000

Ethereum (ETH)

$400,000,000,000

$3,000

120,000,000

Binance Coin (BNB)

$80,000,000,000

$500

180,000,000

3. Trading Volume

Trading volume refers to the total number of units of a cryptocurrency that have been traded over a specific period. It is an indicator of the liquidity and market activity of a cryptocurrency. High trading volume suggests strong interest and potential for price movement.

Cryptocurrency

24-hour Trading Volume

Bitcoin (BTC)

$50,000,000,000

Ethereum (ETH)

$20,000,000,000

Binance Coin (BNB)

$10,000,000,000

4. Price Volatility

Price volatility measures the degree to which the price of a cryptocurrency fluctuates over time. High volatility can indicate uncertainty in the market and can be a sign of speculative trading. It is important to consider volatility when analyzing the potential risks and rewards of investing in cryptocurrencies.

Cryptocurrency

30-day Volatility

Bitcoin (BTC)

30%

Ethereum (ETH)

40%

Binance Coin (BNB)

50%

5. Market Sentiment

Market sentiment refers to the overall attitude of investors towards a particular cryptocurrency or the market as a whole. It can be influenced by news, rumors, and other external factors. Analyzing market sentiment can help predict potential price movements.

Cryptocurrency

Market Sentiment Score

Bitcoin (BTC)

70 (Positive)

Ethereum (ETH)