The Pros and Cons of Cryptocurrency

Introduction

Cryptocurrency, often referred to as digital currency or virtual currency, has gained significant attention in recent years. It is a form of digital or virtual asset designed to work as a medium of exchange. While it offers numerous benefits, there are also several drawbacks associated with its use. In this article, we will explore the pros and cons of cryptocurrency.

Pros of Cryptocurrency

1. Decentralization

One of the primary advantages of cryptocurrency is its decentralized nature. Unlike traditional currencies, which are controlled by central banks, cryptocurrencies operate on a decentralized network called blockchain. This decentralized structure reduces the risk of government intervention and manipulation, as there is no single entity with control over the entire system.

2. Security

Cryptocurrencies use advanced cryptographic techniques to secure transactions. This makes them highly secure and resistant to hacking and fraud. The blockchain technology ensures that all transactions are recorded in a transparent and immutable manner, making it nearly impossible to alter or delete any transaction history.

3. Privacy

Cryptocurrency transactions are pseudonymous, meaning that users can conduct transactions without revealing their personal information. This level of privacy is beneficial for individuals who wish to keep their financial activities confidential.

4. Accessibility

Cryptocurrency is accessible to anyone with an internet connection. This makes it an excellent option for people in remote or underbanked areas who may not have access to traditional banking services.

5. Lower Transaction Costs

Cryptocurrency transactions often have lower fees compared to traditional banking systems. This is because there is no need for intermediaries, such as banks or credit card companies, to process transactions.

Cons of Cryptocurrency

1. Volatility

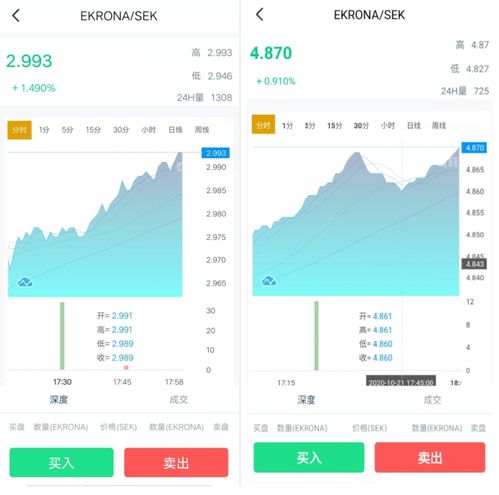

One of the biggest drawbacks of cryptocurrency is its high volatility. The value of cryptocurrencies can fluctuate rapidly, leading to significant gains or losses for investors. This volatility can be risky, especially for those who are not prepared for it.

2. Regulatory Uncertainty

Cryptocurrency is still a relatively new and evolving technology, and governments around the world are still trying to figure out how to regulate it. This regulatory uncertainty can lead to legal and financial risks for users and investors.

3. Security Concerns

While cryptocurrencies are generally secure, they are not immune to security threats. Hackers can target cryptocurrency exchanges and wallets, leading to the loss of funds. Additionally, users must be cautious of phishing scams and other fraudulent activities.

4. Lack of Regulation

The lack of regulation in the cryptocurrency market can lead to fraudulent activities and market manipulation. This can harm both investors and the overall reputation of the cryptocurrency industry.

5. Environmental Impact

The mining process for cryptocurrencies, particularly Bitcoin, requires a significant amount of energy. This has raised concerns about the environmental impact of cryptocurrency mining and its contribution to climate change.

Conclusion

Cryptocurrency offers several advantages, such as decentralization, security, privacy, accessibility, and lower transaction costs. However, it also has several drawbacks, including volatility, regulatory uncertainty, security concerns, lack of regulation, and environmental impact. As with any investment, it is essential to weigh the pros and cons before deciding whether to invest in cryptocurrency.